We're here 24/7 to help when you need financial support.

Access your P&S Credit Union accounts anywhere, anytime! Apply for a loan or open an account online 24/7 from your mobile device!

You've got dreams, we've got solutions!

VISA® Credit Cards

introductory rate as low as

4.99% APR

Truck & Auto Loans

as low as

2.49% APR

RV & Boat Loans

as low as

8.00% APR

Personal Loans

P&S Credit Union personal loans take the worry out of borrowing with predictable payments that won't change over time.

Auto Loans

With GAP protection, Vehicle Waranties, Debt Protection and Low Rates, P&S Credit Union has Auto Loans that won't be beat!

Home Equity

Use the equity built in your home to access funds for major expenses with a 10 year draw and a 10 year repayment period.

Savings & CD's

As a member-owned nonprofit, our growth is tied directly to yours. That’s why we strive for superior support and service.

Online Banking

Online Banking provides secure access to your accounts 24/7 from anywhere, using your computer, tablet or smartphone.

Mobile Banking

Put you money in your pocket with Mobile Banking. The P&S Credit Union Mobile App can save YOU time and money!

Credit Union News-

MAR

2024 Lagoon Season Passports Available!

P & S Credit Union

ONLINE Good Any Day Passports Available

Valid for purchase and use for the entire 2024 Lagoon Season.

You may purchase passports TODAY online using your Promo Code!

“Online Terms” for Good Any Day ONLINE Promo Code:

*Single Day Passports to Lagoon ONLINE ONLY for $74.95 + tax for ALL AGES. Passports may be purchased online at www.lagoonpark.com for a discounted rate using your exclusive promo code.

To purchase passports, visit www.lagoonpark.com

Select BUY TICKETS (https://shop.lagoopark.com)

Contact us for the promo code. Enter the code and your discounted tickets will be located at the top of the page for purchase. Up to 12 passports may be purchased per transaction.

MAR

CYBER SECURITY SPOT LIGHT - WHAT IS PHISHING?

P&S Credit Union Wants to Keep You Safe from Scammers!

We will be providing up to date information and ideas on how to protect you and your money from scammers and frauds in our monthly spotlight. There are numerous articles to help you and your family know the risks. A couple of great resources are https://consumer.ftc.gov/consumer-alerts and https://www.usa.gov/scams-and-fraud

This month we are focusing on discussing What is Phishing?

A cunning form of cybercrime, phishing has become a pervasive threat, preying on individuals and organizations. This article aims to shed light on the intricacies of phishing, exploring its definition, various forms, tactics employed by cybercriminals, and essential measures to safeguard against these attacks.

At its core, Phishing is a type of cyber-attack where malicious actors attempt to deceive individuals into giving them sensitive information, such as usernames, passwords, financial details, or other personal information. These actors will often masquerade as trustworthy entities, creating the feeling of legitimacy to lure unsuspecting victims.

There are many forms phishing may appear in. Today we will touch on a few.

- Email Phishing: The most common form of phishing, attackers will send emails that will impersonate reputable organizations or individuals to trick recipients in clicking malicious links or providing sensitive information.

- Spear Phishing: A more targeted approach, spear phishing will involve attacks directed at specific individuals. Cybercriminals will meticulously gather information about their targets to create a personalized and convincing attack.

- Pharming: In a pharming attack, Hackers may manipulate DNS (Domain Name System) settings or, employ malicious software to redirect users from legitimate websites to fraudulent ones to collect sensitive user information

Let us now look at some of the tactics Cybercriminals may employ.

- Social Engineering: Phishing relies heavily on exploiting human psychology to manipulate individuals into making decisions they otherwise wouldn’t. This may involve creating a sense of urgency, fear, or curiosity to prompt immediate responses.

- Spoofed Websites: Phishers will often create convincing replicas of legitimate websites to trick users into entering their credentials. These fraudulent sites can often be challenging to distinguish from their legitimate counterparts, especially for unsuspecting individuals.

- Malicious attachments: Emails or messages may contain innocuous attachments that, when opened, deploy malware into the victim’s device, allowing attackers to gather sensitive information.

Now what can you do to help protect yourself against these malicious individuals?

- Verify the Source: Always scrutinize the sender’s email address or phone number. Legitimate sources will use official communication channels, and deviations should raise suspicion.

- Think Before Clicking: avoid clicking on links or downloading attachments from unfamiliar or unexpected sources.

- Multi-Factor Authentication (MFA): Implementing MFA for emails and financial accounts will add an extra layer of security against data breaches.

- Stay Informed: Regularly update yourself and your organization about the latest tactics employed by fraudsters. Awareness is crucial in recognizing and thwarting evolving threats.

In conclusion, understanding the nuances of phishing is important in fortifying our defenses against Cybercriminals. By recognizing red flags, staying vigilant, and adopting good online security practices, individuals and organizations can thwart the deceptive schemes of Phishers and safeguard their valuable information from falling into the wrong hands.

We Have Many Reasons to Choose P&S Credit Union

P&S Credit Union is "Where People & Service Matter!"

Membership

P&S membership is open to select Union Associations, their families and residents of Salt Lake County.

Learn more >>

VISA® Platinum

Get the purchase power you need with a fixed rate, low interest P&S VISA® Platinum Credit Card.

Learn more >>

Best Rate Guarantee

We do what we can to beat competitors' rates! Get the lowest possible rate with the benefits of P&S Credit Union membership!

Learn more >>

Annual Credit Report

Download your FREE annual credit report from EACH of the three credit bureaus: TransUnion, Experian and Equifax.

Learn more >>

What Our Members Have to Say

Need to Drop Us a Line?

Contact Us

Your voice matters at P&S Credit Union! We love to hear from our members and want to know how we can better serve you. Please feel free to share about your credit union experience or let us know if there's something we can do improve upon what we're doing. We will listen!

Financial Tips and Money Sense

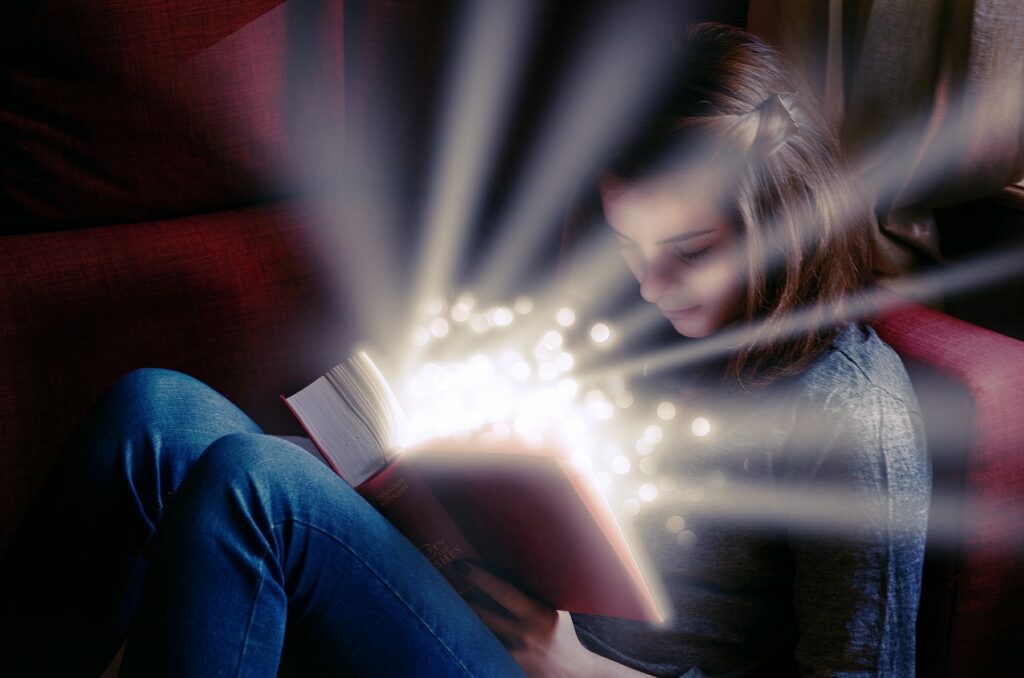

Education

“Education is the most powerful weapon we can use to change the world” -Nelson Mandela To improve your financial abilities getting a good education whether it be from a technical college or university will help you make your financial dreams come true. Most of us have grown up being taught the importance of education. But…

Setting a savings Goal

It’s never too early to start building a strong foundation, and in today’s economy, it’s more important than ever to budget and save. You work hard- you deserve to live comfortably today, tomorrow and always. Get Started Saving It’s important to have a plan in place when you start to save. Take a look at…

Your Credit Score Matters

If your credit history is not where you want it to be, you’re not alone. Improving your credit scores takes time, but the sooner you address the issues that might be dragging them down, the faster your credit scores will go up. The higher your scores, the more likely you are to qualify for loans…